Renters Insurance in and around Lenexa

Renters of Lenexa, State Farm can cover you

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Your personal property matters and so does keeping it safe. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can cover your possessions, from your clothing to your guitar. Wondering how much coverage you need? That's alright! Greg Aldridge is ready to help you identify coverage needs and help secure your belongings today.

Renters of Lenexa, State Farm can cover you

Renters insurance can help protect your belongings

There's No Place Like Home

When renting makes the most sense for you, State Farm can help cover what you do own. State Farm agent Greg Aldridge can help you with a plan for when the unexpected, like a fire or a water leak, affects your personal belongings.

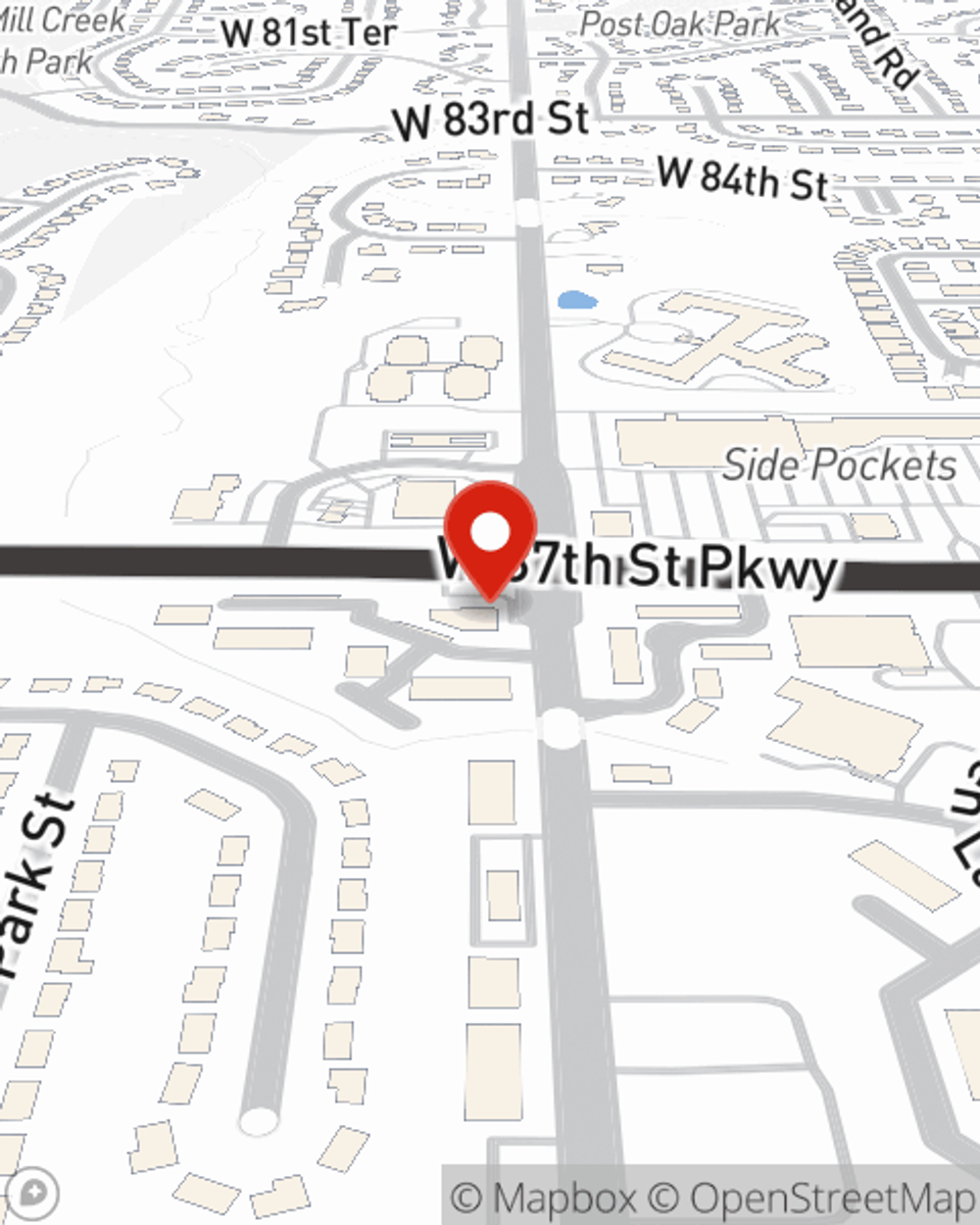

As one of the industry leaders for insurance, State Farm can offer you coverage for your renters insurance needs in Lenexa. Visit agent Greg Aldridge's office to discover a renters insurance policy that can help protect your belongings.

Have More Questions About Renters Insurance?

Call Greg at (913) 492-6080 or visit our FAQ page.

Simple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Greg Aldridge

State Farm® Insurance AgentSimple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.